1. Overview of Income Limits for Roth IRAs

Because it lets your investments grow tax-free, a Roth IRA income limits is one of the most effective tools for retirement savings. However, due to financial limitations, not everyone is able to make a direct contribution. Every year, the IRS establishes income thresholds that determine who is qualified to contribute fully or partially to a Roth IRA. Knowing these limits enables you to make better plans and steer clear of errors that might result in fines or problems with excessive contributions.

2. The Significance of Income Limits for Roth IRA Contributions

There are income restrictions for Roth IRAs because they offer significant tax benefits. Taxes are paid up front when you deposit money into a Roth IRA, and withdrawals are tax-free when you retire. The IRS limits participation to specific income levels because this benefit can be very valuable. These limits are crucial for sound financial planning because if your income is too high, you might not be able to make a direct contribution.

3. 2025 Roth IRA Income Limits

In 2025, your eligibility for full, reduced, or no Roth IRA contributions is determined by the income limits that the IRS modifies annually based on inflation. Depending on your tax filing status—single, married filing jointly, or married filing separately—these limitations are applicable. The restrictions divide people into three groups: those who can make full contributions, those who are in the phase-out zone, and those who make too much money to make direct contributions. You can avoid over-contributing by keeping up with the most recent thresholds.

4. Comprehending Modified Adjusted Gross Income, or MAGI

The IRS uses a specific figure known as MAGI, or Modified Adjusted Gross Income, to determine your eligibility. Your total income after certain deductions and adjustments is known as your MAGI. Because MAGI and AGI are not exactly the same, many taxpayers are confused about MAGI. The first step in determining your eligibility for Roth IRA contributions is to calculate your MAGI. For the majority of people, it is fairly close to their AGI; however, the final figure may vary depending on specific income sources, deductions, or foreign earnings.

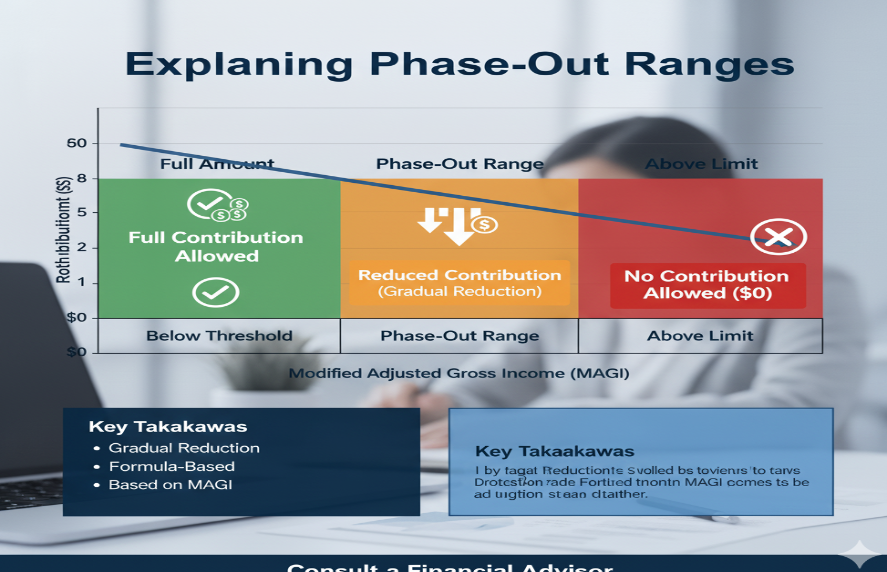

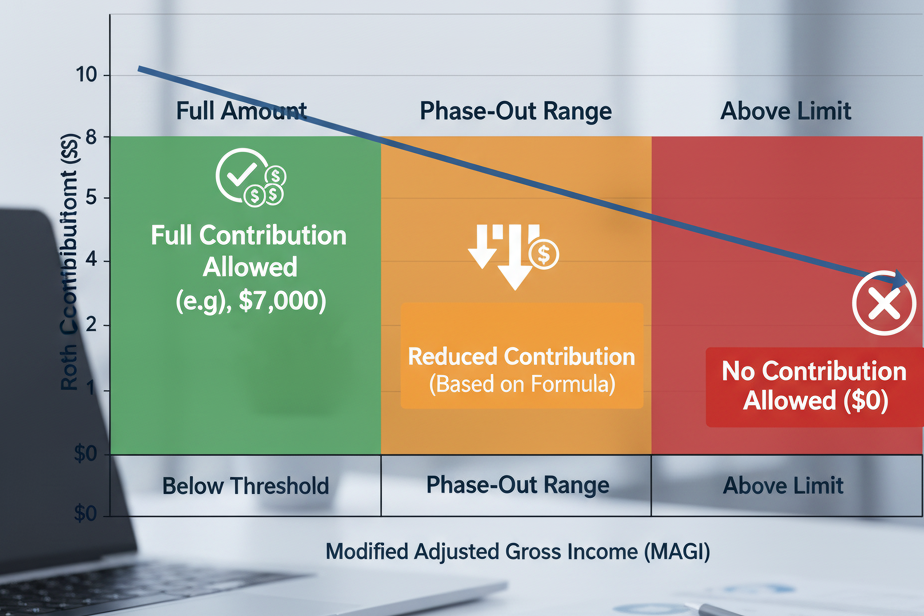

5. Explaining Phase-Out Ranges

Your eligibility gradually declines as your income rises within the phase-out range. You can make a partial contribution if your MAGI is within this range. Your contribution cap decreases as you get closer to the top of the phase-out zone. You are no longer eligible for direct contributions once your income surpasses the upper limit of the range. Many people misinterpret this and either overcontribute or believe they are unable to contribute at all, even though they are still able to. Making accurate contributions requires an understanding of how this range functions.

6. 2025 Contribution Limits

The IRS establishes contribution caps in addition to income caps. Not just your Roth IRA, but all of your IRAs are subject to these caps. Your income and filing status determine whether you are eligible for full or partial contributions. An additional catch-up contribution is permitted if you are 50 years of age or older. These restrictions guarantee that retirement benefits are equitable and balanced for all income levels.

7. How Your Contribution Amount Is Affected by Your Income

The amount you can contribute to a Roth IRA is directly determined by your income. You may make the maximum contribution permitted by the IRS if your MAGI is below the phase-out range. Your contribution is lowered proportionately if your income falls within the phase-out zone. You are unable to make any direct contributions if your income exceeds the cap. The most important thing to keep in mind is that your eligibility varies every year, so in order to prevent overfunding your account, you should review the IRS guidelines every year.

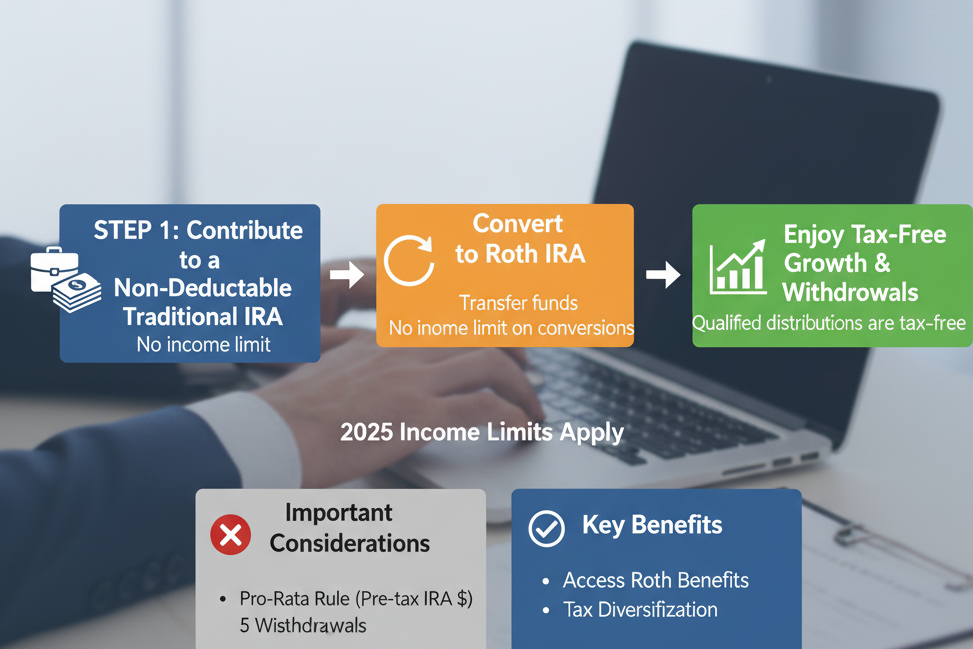

8. High Earners’ Backdoor Roth IRA Option

The Backdoor Roth IRA is a potent substitute for people whose income is too high for direct contributions. This tactic entails making a traditional IRA contribution, which is subsequently converted to a Roth IRA. High-income earners who desire tax-free retirement growth frequently use it, and it is entirely legal. However, if you already have other traditional IRA balances, the conversion may result in taxes, so careful planning is necessary. Additionally, a fundamental comprehension of the pro-rata rule is required. The Backdoor Roth IRA is still one of the greatest ways to take advantage of Roth benefits for people who are unable to make direct contributions.

9. Frequently Made Errors Regarding Roth IRA Income Rules

A lot of investors make mistakes because they don’t understand IRS regulations. One frequent error that leads to excessive contributions is basing contributions on gross income rather than MAGI. Assuming you can contribute at any income level without verifying annual limits is another error. There are penalties for each year that excess contributions remain in the account because some people fail to remove them before the deadline. Others forget that income can fluctuate from year to year and believe that once they earn too much, they must permanently cease contributing. The best way to prevent these mistakes is to review updated limits once a year.

10. Concluding Remarks: Selecting the Optimal Approach Depending on Your Income

Understanding income limits is crucial to making the most of Roth IRAs, which are a potent tool for long-term financial security. Choosing the appropriate plan for your income situation is crucial, regardless of whether you are eligible for full contributions, partial contributions, or the Backdoor Roth strategy. You can maximise your retirement benefits and avoid penalties by staying informed, as tax laws are subject to annual changes. A Roth IRA can offer lifetime tax-free income and significant retirement financial freedom with the appropriate approach.